Take these steps to make Online and Mobile Banking even more secure.

First Interstate has multifactor authentication (MFA) to protect your account from unauthorized access. Sometimes called “Two-Step Verification,” multifactor authentication is a way of confirming your identity when you try to sign in.

The first time you sign in on a new device or our mobile app you enter your username and password as usual, then you get prompted to utilize a second authentication factor — a one-time passcode — to verify your identity. The one-time passcode can be delivered via phone call, text, or authenticator app.

Enabling MFA via authenticator app is not required, but doing so gives you an even more secure layer of protection, plus peace of mind, knowing your credentials are safe.

We recommend using your desktop or laptop computer, with your mobile device close at hand, during the setup process.

Best Practice: Use an Authenticator App

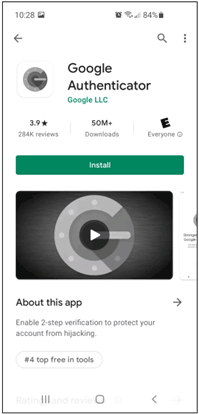

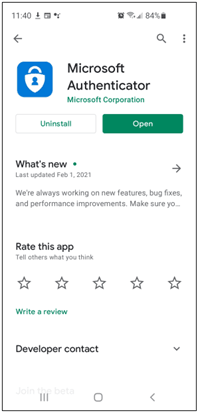

Using your mobile device, download either Google Authenticator or Microsoft Authenticator from your app store. Both authenticator apps generate a new, random one-time passcode every 30 seconds, which you must enter in addition to your usual login credentials.

If your login credentials are compromised for any reason, the authentication process won’t be completed without the correct one-time passcode generated by your authenticator app. If you mistakenly enter the wrong one-time passcode, the authenticator app will generate new code to gain access.

This example shows the steps with Google Authenticator. The experience is similar on both authenticator apps.

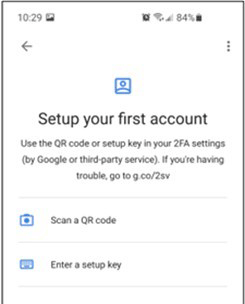

After successful download, open the authenticator app and select "Get Started." Set your mobile device aside; you’ll return to the authenticator app in a moment.

Adjust Your Security Settings

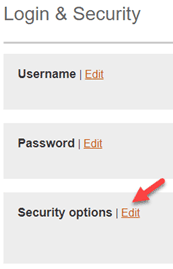

It may be convenient to use a desktop or laptop computer for this step. If you are not enrolled in authentication by authenticator app, you can always enable this option later within Online or Mobile Banking by navigating to My Settings > Login & Security > Security Options > Edit.

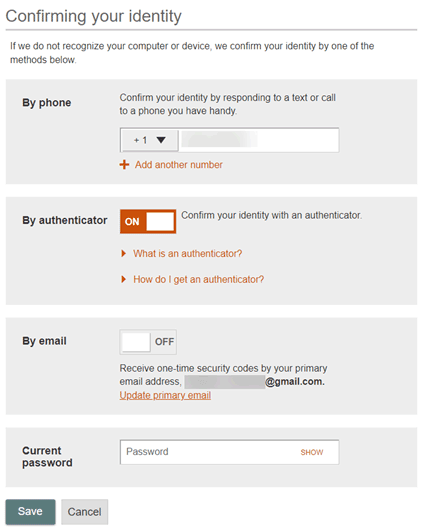

Under Confirming Your Identity, choose By Authenticator > On > enter your current password > Save.

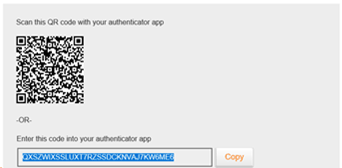

Save this setting to generate a code for your authenticator app.

You will need to provide the code to the authenticator app you downloaded earlier to finish setup and register it. More on this in the next section.

Enable Authentication

Returning to your mobile device, in the authenticator app select "Scan a QR Code."

Scan the code that displays on the Online/Mobile Banking screen (see previous section). This will connect Online or Mobile Banking to the Google Authenticator.

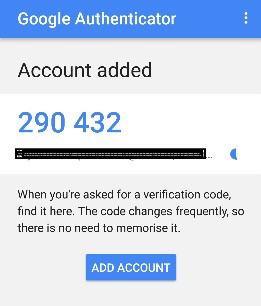

Once connected, Google Authenticator will generate random one-time passcodes that can be used for authentication within Online and Mobile Banking instead of receiving the code via text message or phone call. Below is an example of what a one-time passcode might look like.

Take This Precaution

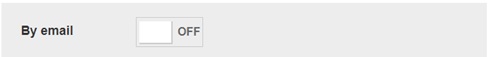

We recommend disabling authentication by email to prevent unregistered devices from requesting a passcode via email. To disable the email authentication, sign into Online Banking and select My Settings > Login & Security > Security Options > Edit > By Email > Off > enter your current password > Save.

You may also call our Client Contact Center at 855-342-3400 for assistance disabling the email authentication option.

Sign In Securely

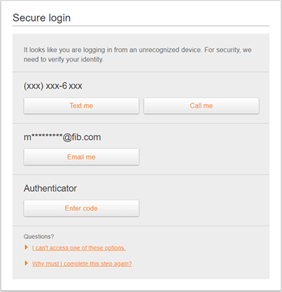

The next time you sign into Online or Mobile Banking on an unregistered or unauthenticated device, multi-factor authentication will kick into action. You will be greeted with this screen asking you to verify your identity. Select the desired authentication method – text, phone call, or authenticator app.

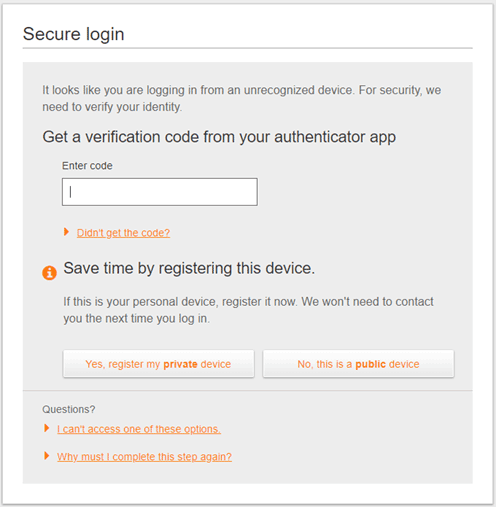

If using an authenticator, enter the one-time passcode generated within your Google or Microsoft Authenticator app on your mobile device. The randomly generated one-time passcodes are good for 30 seconds. After 30 seconds have passed, the authenticator generates a new code.

Then indicate if you are using a private or public device.

If you have questions or need assistance, connect with your local banker or contact the Client Contact Center at 855-342-3400 Monday through Friday, 7:30 a.m. to 7:00 p.m. Mountain Time, and Saturdays, 9:00 a.m. to 2:00 p.m. Mountain Time.

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. Government