How can you avoid service charges on your Basic Checking account? It comes down to minding dates and dollars.

Service charges refer to any fees imposed by financial institutions on clients for account set-up, maintenance, and minor transactional services. These fees may be charged on a one-time or ongoing basis, depending on the account, and in some cases may be waived when clients exhibit certain financial behaviors during a set period.

Learn the Lingo

It helps to speak the language banks use, so let’s learn some vocabulary.

A checking account statement summarizes all the account's monthly transactions and is sent by First Interstate to the account holder in paper or digital form.

Every account has an account cycle during which banking services are provided by First Interstate to the client on a recurring basis. The account cycle, also called a statement cycle, is the range of dates your statement period starts and ends. It's approximately 30 days long.

The cycle date is when your account cycle period ends, also known as a statement closing date.

Pay attention to this: Your statement cycle, and thus statement closing date, is different from a standard calendar month and can vary slightly from one month to the next because statements won’t close on a weekend or holiday.

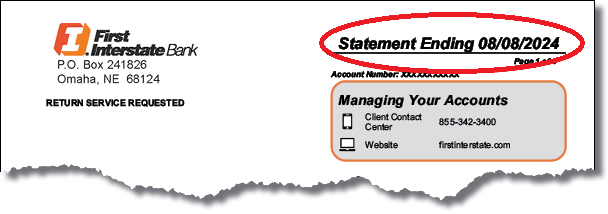

Your statement cycle is unique to your account, so look for your statement ending date at the top of each statement page of your statement.

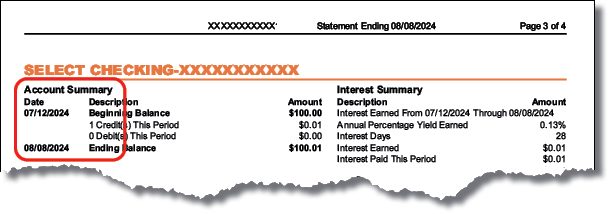

Each statement will show the statement cycle’s start and end date in the Account Summary next to the "Beginning Balance" and "Ending Balance“ disclosures.

Still not sure how to determine your cycle date? Contact your local banker or the Client Contact Center at 855-342-3400. Representatives are available Monday-Friday from 7:30 a.m. to 7 p.m. MT and Saturday from 10 a.m. to 2 p.m. MT.

Avoid Fees

Minding your statement cycle is important because First Interstate will waive the service charge on Basic Checking if you keep a minimum daily balance in the account during your statement cycle or make a direct deposit during your statement cycle. Be thoughtful about when you make deposits and withdrawals, and you’ll avoid service charges.

It's also a good idea to review the features and benefits of your checking account because you might be eligible for an account that’s a better fit for your financial lifestyle. For example, Select Checking has no service charges for clients aged 60 years or older. If you’re an older adult who uses Basic Checking, it’s time for an upgrade.

Remember, requirements vary by account type, so be sure to examine the disclosures specific to your account and feel free to ask your banker any questions.